By David Fearnley

The volatility that gripped equity markets earlier this week re-emerged overnight, as the US Dow Jones fell more than 1,000 points (3.5%) over concerns that rising interest rates will drag down economic growth. While we don't know when the equity market's recent volatility will settle down, it's important to consider the big picture and not get caught up in short-term changes in sentiment.

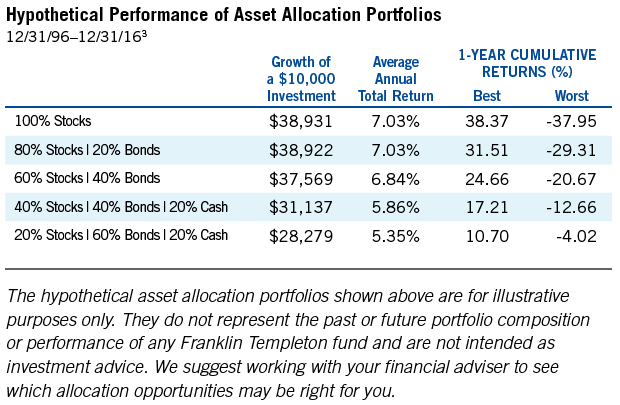

Many investors may be looking for reassurance when markets get rocky so we have provided a list of Five Things You Need to Know to Ride Out a Volatile Stock Market.

1. WATCHING FROM THE SIDELINES MAY COST YOU

When markets become volatile, a lot of people try to guess when stocks will bottom out. In the meantime, they often park their investments in cash. But just as many investors are slow to recognise a retreating stock market, many also fail to see an upward trend in the market until after they have missed opportunities for gains.

Missing out on these opportunities can take a big bite out of your returns. Consider that in the 12 months following the end of a bear market, a fully invested stock portfolio had an average total return of 37.4%. However, if an investor missed the first six months of the recovery by holding cash, their return would have been

only 7.5%.

The table below is a hypothetical illustration showing the risk of trying to time the market. By missing just a few of the stock market’s best single-day advances, you could put a real crimp in your potential returns.